quicken tax planner problem

Quicken billing. Youll get the most out of the tax tools in Quicken such as the Tax Planner by setting up your paycheck at the beginning of the tax year.

Quicken Phone Support By Certified Experts Live Quicken Experts For Help Helpline 1866 209 3656 For Qu Tax Software Best Tax Software Online Accounting Courses

Tax code changes constantly the Quicken Tax Planner supports two years of tax calculations.

. Using Quicken 2005 Premier - Im having a problem with the Tax Planner in that my pretax contributions are not being deducted from my salary in Tax Planner. Quicken is a great tool for small businesses. Quicken VR3923 Tax reports are not correct for State Estimated Taxes.

You can also remove FixQuickenHiRes from your computer. After installing the patch restart your computer. On May 2 my old problem returned - same two tax fields same repeatable behavior.

If installing the patch. I can confirm the fix unbricked the Tax Planner and now shows data for 2020 2021 as it should. Up to 5 cash back Quicken for Mac imports data from Quicken for Windows 2010 or newer Quicken for Mac 2015 or newer Quicken for Mac 2007 Quicken Essentials for Mac Banktivity.

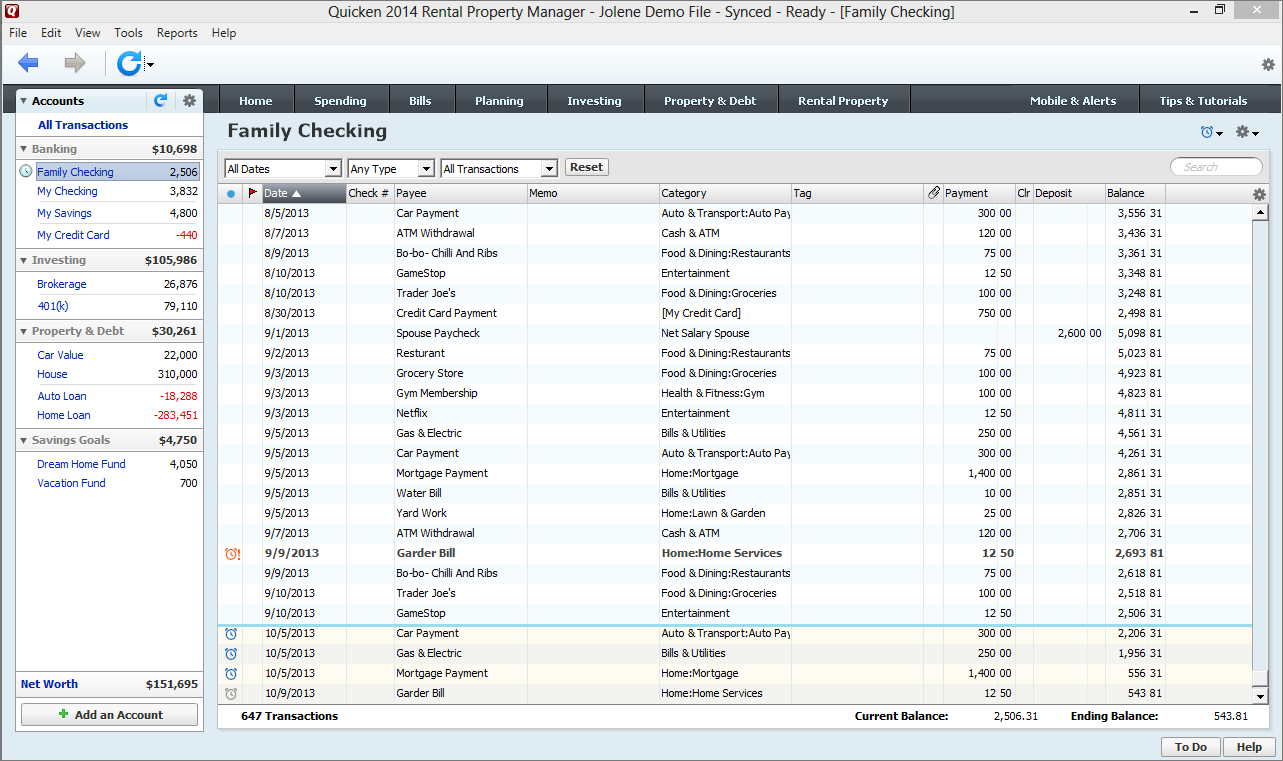

Location on 32-bit Windows. In Reports Windows Running Tax reports for year 2021 the Federal Estimated Tax totals are correct Includes payment made Jan 10 2022 as a part of the tax year 2021 But the State Estimated Tax Totals does NOT include the Jan 10 2022. I dug into the budgeting tool with.

Im using the Paycheck form feature and have the pretax retirement contributions in the proper area and the taxable income at the bottom of the form seems to be. To get the most accurate estimate of your taxes you might decide to fine-tune the values in the Tax Planner. Right-click QWexeManifest and select Delete.

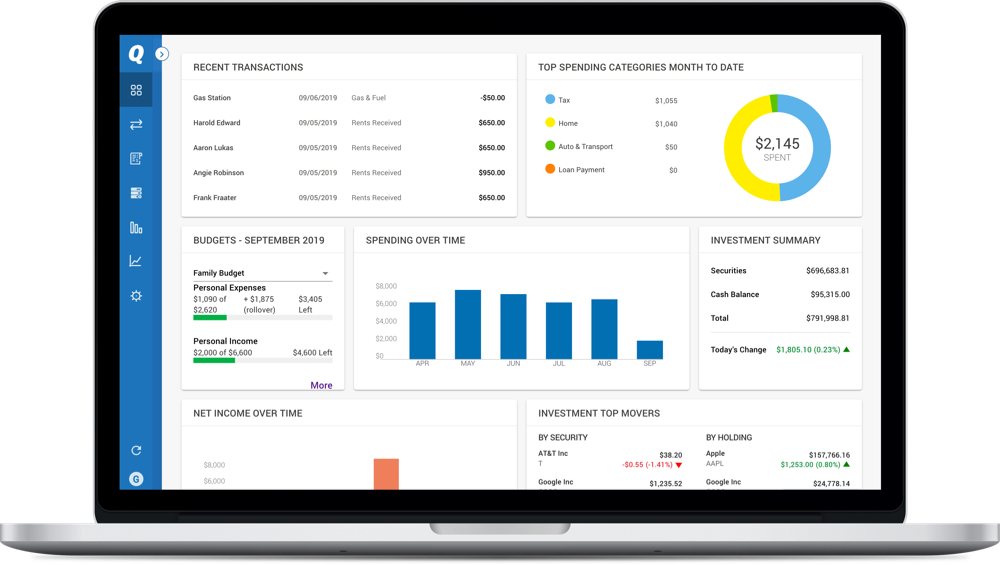

Try reinstalling the update patch. Quicken should review their release planning schedule and make changes to prioritize the allocation of resources for annually updating tax schedules that are posted by the IRS every year in late October or the first week of November. Simplifi by Quicken is designed to provide a visual snapshot of your financial health.

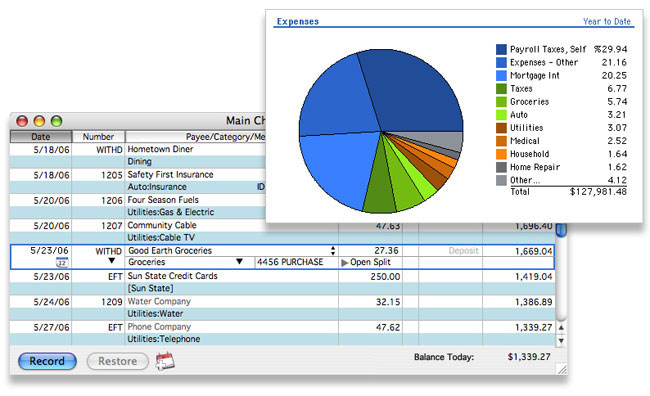

Whether you use tax preparation software or work with an accountant knowing what you can claim on your taxes can help you plan for the upcoming tax year and minimize your tax burden. Quicken can help you adjust your year-to-date totals using the Paycheck wizard. If you didnt do that its okay.

Select your Quicken version year and then download and install the update patch. If you use that versions Tax Planner in 2022 Quicken displays your current. Using Quicken 2005 Premier - Im having a problem with the Tax Planner in that my pretax contributions are not being deducted from my salary in Tax Planner.

Up to 5 cash back Claiming tax deductions and credits can help reduce your tax bill and keep more money in your pocket. I use Quicken Premier and Im on release 2314. Just as a point of fact Intuit the owners of Mint sold Quicken about five years ago to HIG Capital a hedge fund capital group.

To set up a new paycheque click the Planning tab then click the Tax Centre button if it isnt already open. 30-day money back guarantee. Go to the Quicken Program Files folder.

Click the Add Paycheck button. Here is a list of 10 tax deductions credits and tactics. You can manually enter projected amounts for information you choose not to track in Quicken remember to enter a full years worth.

An issue where the new status blue icon of a transaction was not cleared after the transaction was edited. If youre not satisfied return this product to Quicken within 30 days of purchase with your dated receipt for a full refund of the purchase price less. So Quicken Inc and thus Quicken.

This morning May 4 I opened Quicken saw that the Tax Planner problem was present and I immediately ran Super-Validate. The service handles account tracking across banks investments and credit cards and payment services and. TurboTax will import both the mileage and the tax-deductible dollar amounts.

Click Add Paychequ e then enter the information Quicken requests. The problem disappeared it now appears to be running properly once again. Im using the Paycheck form feature and have the pretax retirement contributions in the proper area and the taxable income at the bottom of.

For some reason I cannot get the Tax Planner to save certain settings. Specifically its not saving Scheduled Bills and Deposits under Other Income or Losses Its also not saving Scheduled Bills and Deposits under Withholdings. Youll find it below the.

Updated the W4 tax rates and mileage rates in the Tax Planner. Location on 64-bit Windows. You can find the list of patches here.

Click the Planning tab and then click the Tax Center button. For example the Subscription Release of Quicken is currently in 2022 so its Tax Planner supports calculations for tax years 2022 and 2021. To edit all future paycheques of a paycheque youve already set up choose Tools menu Manage Bill Income Reminders List find the paycheque in the list then right-click the paycheque name and.

An issue where a subscription alert message could still display immediately after the subscription was renewed due to a timing problem with alerts. If you use a different tax preparation software package or do your taxes by hand you can use the mileage records in the Vehicle Mileage Tracker to help you enter your mileage on your. Because the US.

The Home Business edition of Quicken is a hidden gem in our line-upFor far less than the cost of most small business financial tools you get a complete small business accounting product plus all the personal finance tools you get with Quicken Premier such as account tracking budgeting planning investment. The current year and the year prior. Quickens robust financial planning tool includes several options such as budgeting tax planning and long-term planning.

The official name of the Quicken company is Quicken Inc. If you use TurboTax you can import your mileage from Quicken directly into TurboTax. Right-click the Start menu and select File Explorer.

Tax Planner Issues.

401k Scheduled Deductions In Tax Planner Quicken

How I Learned To Love Quicken Deluxe And Give Up On The Past Tidbits

Quicken Famiglio Associates Cpas Tax Accountants Financial Advisors

Download Quicken For Mac Macupdate

Estimated Tax Math In Planner Seems Incorrect Quicken

Quicken Support Phone Number 1877 980 4312 24 7 By Quicktech Solution Quicken Helpful Support Services

Quicken Phone Support Number By Experts Certified Accounting Experts Are Here To Help You Dial 1866 Accounting Software Financial Information Business Support

Quicken For Mac 2016 Review Un Kill Bill Pay

Tax Planner Other Withholding Using Wrong Total Quicken

Pin By Kain Tecnologies On Tech Support Flamingo Supportive Tech Support

Is There A Problem With Split Categories When Entering Transactions In Investments Quicken

Quicken 2010 Review Moneyspot Org

How I Learned To Love Quicken Deluxe And Give Up On The Past Tidbits

Quicken 2019 For Mac Review Robert Breen

Pin By Kain Tecnologies On Tech Support Flamingo Supportive Tech Support

How I Learned To Love Quicken Deluxe And Give Up On The Past Tidbits

Quicken 2010 Review Moneyspot Org